[ad_1]

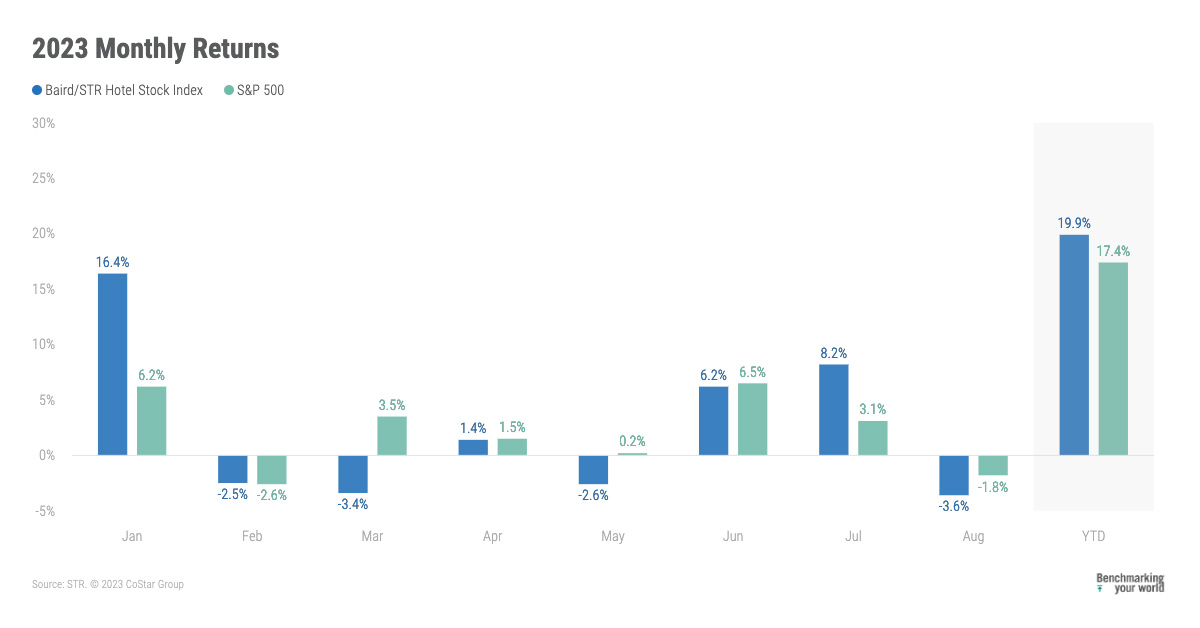

HENDERSONVILLE, Tennessee, and MILWAUKEE – The Baird/STR Lodge Inventory Index fell 3.6% in August to a degree of 5,856.

Lodge shares pulled again and underperformed in August with Lodge REITs the laggards. The Lodge REITs posted their worst month of the yr on account of weak second quarter earnings stories, diminished full-year steerage expectations, and a number of other weather-related impacts throughout the nation through the month; relative efficiency would have been even worse if not for Hersha’s take-private announcement over the last week of the month. Michael Bellisario, senior lodge analysis analyst and director at Baird

U.S. lodge efficiency confirmed improved year-over-year development in August, as RevPAR rose 1.7% over 2022 due to a 2% enhance in ADR. General, summer season efficiency was decrease yr over yr as extra Individuals traveled internationally, and inbound journey to the U.S. remained at a deficit. We anticipate stronger efficiency within the coming months as group and convention demand accelerates to its annual peak. Amanda Hite, STR president

In August, the Baird/STR Lodge Inventory Index fell behind the S&P 500 (-1.8%) and the MSCI US REIT Index (-3.2%).

The Lodge Model sub-index dropped 2.2% from July to 11,242, whereas the Lodge REIT sub-index decreased 9.1% to 1,027.

Concerning the Baird/STR Lodge Inventory Index and Sub-Indices

The Baird/STR Lodge Inventory Index was set to equal 1,000 on 1 January 2000. Final cycle, the Index peaked at 3,178 on 5 July 2007. The Index’s low level occurred on 6 March 2009 when it dropped to 573.

The Lodge Model sub-index was set to equal 1,000 on 1 January 2000. Final cycle, the sub-index peaked at 3,407 on 5 July 2007. The sub-index’s low level occurred on 6 March 2009 when it dropped to 722.

The Lodge REIT sub-index was set to equal 1,000 on 1 January 2000. Final cycle, the sub-index peaked at 2,555 on 2 February 2007. The sub-index’s low level occurred on 5 March 2009 when it dropped to 298.

The Baird/STR Lodge Inventory Index and sub-indices can be found completely on Lodge Information Now. The indices are cobranded and had been created by Robert W. Baird & Co. (Baird) and STR. The market-cap-weighted, price-only indices comprise 20 of the biggest market-capitalization lodge firms publicly traded on a U.S. trade and try to characterize the efficiency of lodge shares. The Index and sub-indices are maintained by Baird and hosted on Lodge Information Now, usually are not actively managed, and no direct funding will be made in them.

As of 31 August 2023, the businesses that comprised the Baird/STR Lodge Inventory Index included: Apple Hospitality REIT, Ashford Hospitality Belief, Chatham Lodging Belief, Alternative Motels Worldwide, DiamondRock Hospitality Firm, Hersha Hospitality Belief, Hilton Inc., Host Motels & Resorts, Hyatt Motels, InterContinental Motels Group, Marriott Worldwide, Park Motels & Resorts, Inc., Pebblebrook Lodge Belief, RLJ Lodging Belief, Ryman Hospitality Properties, Service Properties Belief, Summit Lodge Properties, Sunstone Lodge Buyers, Wyndham Motels & Resorts, and Xenia Motels & Resorts.

This communication will not be a name to motion to interact in a securities transaction and has not been individually tailor-made to a particular consumer or focused group of shoppers. Analysis stories on the businesses recognized on this communication are supplied by Robert W. Baird & Co. Integrated, and can be found to shoppers by way of their Baird Monetary Advisor. This communication doesn’t present recipients with data or recommendation that’s enough on which to base an funding choice. This communication doesn’t consider the precise funding goals, monetary scenario or want of any specific consumer and will not be appropriate for all sorts of traders. Recipients ought to contemplate the contents of this communication as a single think about investing choice. Further elementary and different analyses could be required to make an funding choice about any particular person safety recognized on this launch.

About Baird

Placing shoppers first since 1919, Baird is an employee-owned, worldwide wealth administration, asset administration, funding banking/capital markets, and personal fairness agency with workplaces in the USA, Europe and Asia. Baird has greater than 5,000 associates serving the wants of particular person, company, institutional and municipal shoppers and greater than $375 billion in consumer belongings as of December 31, 2022. Dedicated to being an excellent office, Baird ranked No. 23 on the 2023 Fortune 100 Greatest Firms to Work For® record – its twentieth consecutive yr on the record. Baird is the advertising title of Baird Monetary Group. Baird’s principal working subsidiaries are Robert W. Baird & Co. Integrated and Baird Belief Firm in the USA and Robert W. Baird Group Ltd. in Europe. Baird additionally has an working subsidiary in Asia supporting Baird’s funding banking and personal fairness operations. For extra data, please go to Baird’s web site at www.rwbaird.com.

About STR

STR supplies premium knowledge benchmarking, analytics and market insights for the worldwide hospitality trade. Based in 1985, STR maintains a presence in 15 international locations with a North American headquarters in Hendersonville, Tennessee, a global headquarters in London, and an Asia Pacific headquarters in Singapore. STR was acquired in October 2019 by CoStar Group, Inc. (NASDAQ: CSGP), a number one supplier of on-line actual property marketplaces, data and analytics within the industrial and residential property markets. For extra data, please go to str.com and costargroup.com.

Haley LutherCommunications Supervisor+1 (216) 278 0627STR

View supply

[ad_2]

Source link