1. Introduction

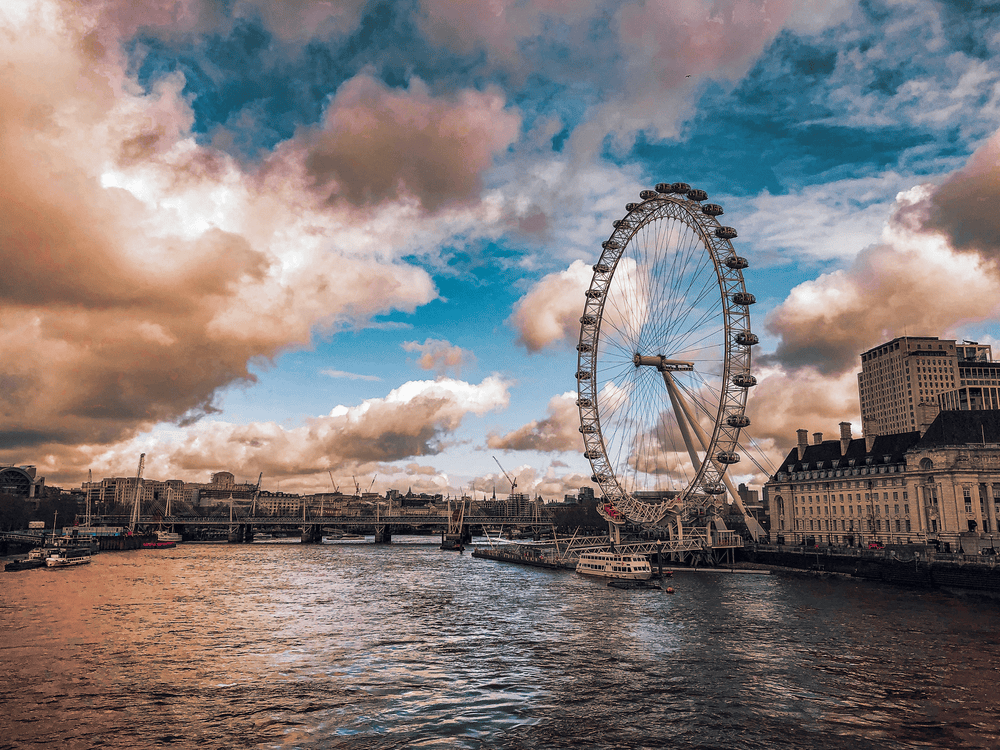

The UK hospitality sector remains one of the nation’s largest employers and economic drivers, with more than 2.6 million people working directly in the industry and a total economic footprint exceeding £140 billion when including indirect contributions, according to industry and parliamentary data. The sector also delivers around £54 billion in annual tax revenue, underscoring its fiscal importance.

Yet 2025 finds the industry in a delicate balance. While domestic tourism remains robust and inbound travel is rebounding, operators continue to face labour shortages, high energy bills, and shifting consumer demands. This dual reality—economic weight combined with structural fragility—makes hospitality a bellwether for the wider UK economy. At Hotel Magazine, we examine how these forces are reshaping the industry in 2025 and what lies ahead.

2. The Current UK Hospitality Landscape

The sector’s 2025 market value is estimated at £48.4 billion (USD 61.2 billion), with growth projected to reach £57.5 billion (USD 72.8 billion) by 2030, according to Mordor Intelligence. A separate outlook from Research and Markets places today’s value closer to £46.5 billion (USD 58.8 billion), but both point to steady medium‑term expansion.

Hotel performance data paints a nuanced picture. VisitBritain reports that in June 2025, occupancy held at 83% year‑on‑year, while ADR slipped 5% to £181, pulling RevPAR down 4% to £150. London’s resilience stands out: despite more than 4,200 new rooms opening in 2024—and a further 757 luxury rooms expected in 2025—average occupancy climbed to 82%, broadly matching pre‑pandemic levels, with ADR easing only marginally to £228, according to HospitalityNet and the Financial Times.

3. Post‑Pandemic Recovery and Shifting Guest Expectations

The demand outlook is broadly positive. PwC’s UK Hotels Forecast expects inbound tourism to recover to 99% of pre‑pandemic levels by the end of 2025, helped by a weaker pound making Britain more affordable. Domestic tourism remains supportive, with staycations sustaining occupancy in secondary markets, as highlighted by CBRE.

Guest expectations are evolving quickly. EHL Hospitality Insights notes rising demand for personalised service, wellness‑focused stays, and eco‑friendly practices, pushing operators toward AI‑driven personalisation and credible sustainability credentials. Workforce dynamics remain challenging: the industry shed more than 83,000 jobs from late‑2024 amid higher employer costs, according to The Times. At the same time, older workers are returning: baby‑boomer employment in casual hospitality roles rose by 10% in 2024, reports the Financial Times.

4. Major Challenges Facing the Sector

Despite resilient demand, the sector faces persistent headwinds. A continued labour market squeeze—driven by higher employer contributions and wage floors—has tightened margins, with staffing already the largest operating cost line. Rising energy bills, food inflation, and rents further pressure profitability, dynamics described as “overheads crippling the sector” by The Guardian. Competition from short‑term rental platforms continues to reshape demand, with Airbnb and peers eroding share in budget and midscale segments, particularly outside London, as outlined by CBRE.

5. Technology’s Growing Role

Technology is the clearest lever to defend margins while elevating service. Operators are rolling out AI‑powered guest services (chatbots, virtual concierges) to streamline front‑of‑house and deploying dynamic pricing systems to optimise occupancy and revenue—both trends highlighted by PwC. Smart‑room tech—mobile key, app‑based check‑in, voice controls—is maturing, with over half of European operators prioritising digital guest experience, according to EHL Hospitality Insights. Sustainability‑tech adoption is also accelerating, from energy‑management platforms to AI food‑waste systems such as Winnow and Kitro.

6. Sustainability as a Market Differentiator

Sustainability has moved from optional to essential. A Booking.com survey finds 74% of UK travellers actively seek sustainable choices, with many willing to pay a premium. Hotels are investing in energy‑efficient retrofits (LED, solar, smart HVAC) that cut costs and enhance asset value, trends reinforced by CBRE. Credible certification strengthens positioning and pricing power—labels such as Green Key and EarthCheck are increasingly sought by both guests and investors.

7. Investment and Financing Trends

Capital is returning, but with stricter filters on quality, location and ESG. Total UK hotel investment is forecast to reach £5.7 billion in 2025, up from £4.8 billion in 2024, according to Savills. London remains the magnet for institutional capital and sovereign wealth, while regional hubs—Manchester, Edinburgh, Birmingham—are gaining momentum for lifestyle and boutique concepts.

Private equity activity remains robust, with firms like Blackstone and Brookfield targeting turnarounds and platform plays. Creative structures are more common: sale‑and‑leasebacks, management contracts, and revenue‑share agreements provide capital flexibility for operators. Fractional models—via platforms like The Hideaways Club—are also carving out a niche in luxury. ESG alignment increasingly influences both valuation and lending terms, per CBRE.

8. Future Forecast: 2025–2030

The five‑year outlook is cautiously optimistic. Industry research suggests expansion from £48.4 billion (USD 61.2 billion) in 2025 to roughly £57.5 billion (USD 72.8 billion) by 2030—a 3.5% CAGR—per Mordor Intelligence. Even Research and Markets points to steady growth, to about £52.7 billion (USD 66.7 billion) by 2030.

Likely winners are operators combining scale with innovation: global brands such as Hilton, Marriott, and IHG Hotels & Resorts will keep leveraging loyalty and distribution, while distinctive boutique and lifestyle concepts win share with authentic experiences and sustainable operations. Risks include wage inflation, policy uncertainty, and localized oversupply—especially in London’s luxury tier, where nearly 757 new rooms are slated for 2025, per the Financial Times.

9. Conclusion

The UK hospitality industry in 2025 stands at a crossroads: economically vital, yet facing sustained cost and labour headwinds. Still, occupancy stabilisation and near‑full recovery in inbound demand signal resilience—trends echoed by VisitBritain. The road to 2030 will reward operators that execute on three fronts: technology adoption, sustainability integration, and financing agility.

In short: UK hospitality is evolving, not shrinking. Published by Hotel Magazine, this forecast concludes that operators investing in digital transformation, verified ESG, and flexible capital structures will thrive, while those slow to adapt risk being left behind.